4. FRAUDULENT TRANSACTIONS

Subject to clause 2.1 and 2.2 of this Part I: Specific Terms for Online Payment Aggregation Services, if Razorpay is intimated by a Facility Provider that a customer has reported an unauthorised debit of the customer’s Payment Instrument (“Fraudulent Transaction”), then in addition to its rights under clause 16 of Part A: General Terms and Conditions, Razorpay shall be entitled to suspend settlements to You during the pendency of inquiries, investigations and resolution thereof by the Facility Providers.

If the amount in respect of the Fraudulent Transaction has already been settled to You pursuant to these Terms, any dispute arising in relation to the said Fraudulent Transaction, following settlement, shall be resolved in accordance with the RBI’s notification DBR.No.Leg.BC.78/09.07.005/2017-18, dated July 6, 2017 read with RBI’s notification DBOD.LEG.BC 86/09.07.007/2001-02 dated April 8, 2002 and other notifications, circulars and guidelines issued by the RBI in this regard from time to time.

Subject to clause 4.2 above, if the Fraudulent Transaction results in a Chargeback, then such Chargeback shall be resolved in accordance with the provisions set out in the Terms.

You acknowledge that Razorpay shall not be responsible for any liability arising in respect of Fraudulent Transactions whether it is an international or a domestic transaction.

You shall be liable in the event of breach of the fraud amount thresholds as provided under the NPCI guideline on ‘Fraud liability guidelines on UPI transactions’ NPCI/2022-23/RMD/001. You hereby understand and agree that the decision of the NPCI or the concerned acquiring bank shall be final and binding.

5. GENERAL

In the event of any conflict between Part A: General Terms and Conditions and Part B: Specific Terms and Conditions, Part B: Specific Terms and Conditions shall prevail. Both parts shall be harmoniously construed as far as possible.

Capitalised terms used but not defined in this Part I: Specific Terms for Online Payment Aggregation Services of Part B shall have the meaning ascribed to such terms in Part A: General Terms and Conditions.

Clauses 2 and 4 of Part I: Specific Terms for Online Payment Aggregation Services of Part B shall survive the termination of the Terms.

You consent for Razorpay to share Your information/data, including activity-related and personal information, with its Affiliates — for marketing, facilitating products and services, and sharing with Facility Providers for eligibility checks. To revoke or modify consent, contact support.razorpay.com.

If You have opted for a loan/credit product through Razorpay’s affiliates or partners, You agree that Razorpay may recover dues from Your positive balance. Depending on product type:

If NACH mandate fails, recovery will happen from Razorpay balance.

If Razorpay balance is first mode of repayment, recovery will happen directly from it.

Razorpay may deduct amounts from Your settlement account per Your instructions. Razorpay may first deduct fees, chargebacks, fines, and penalties before other deductions.

6. COMPLIANCE WITH PAYMENT AGGREGATOR GUIDELINES

You represent and warrant that during the entire term of using the Services, You will comply with all requirements under Applicable Laws, including Payment Aggregator Guidelines.

You must display on Your website/app:

(a) Clear return and refund policy, including timelines;

(b) General terms and conditions for customer use.

You must deliver products/services as promised and shall not store or retain any customer Payment Instrument data. If any data breach or security issue occurs, You must immediately inform Razorpay.

You must set up a grievance redressal mechanism for customer complaints (via phone, email, or online) and respond within 5 business days of receiving a complaint.

You must comply with PCI DSS and PA DSS standards, submit annual compliance proof to Razorpay, and notify Razorpay if You fail to comply.

Razorpay reserves the right to audit Your compliance. You must cooperate fully.

Any data security incident must be reported at: https://razorpay.com/grievances/

7. SERVICE DESCRIPTIONS

7.1 Optimizer

“Optimizer Services” is a Razorpay-developed SaaS solution that lets You route payments through specific gateways based on Your business conditions. Razorpay’s role is limited to providing the software layer, not as a payment service provider.

You consent to Razorpay using or processing Your data for Optimizer Services and agree to pay additional applicable fees.

You indemnify Razorpay against any claims or losses arising from disputes related to Optimizer Services.

7.2 Value Added Services

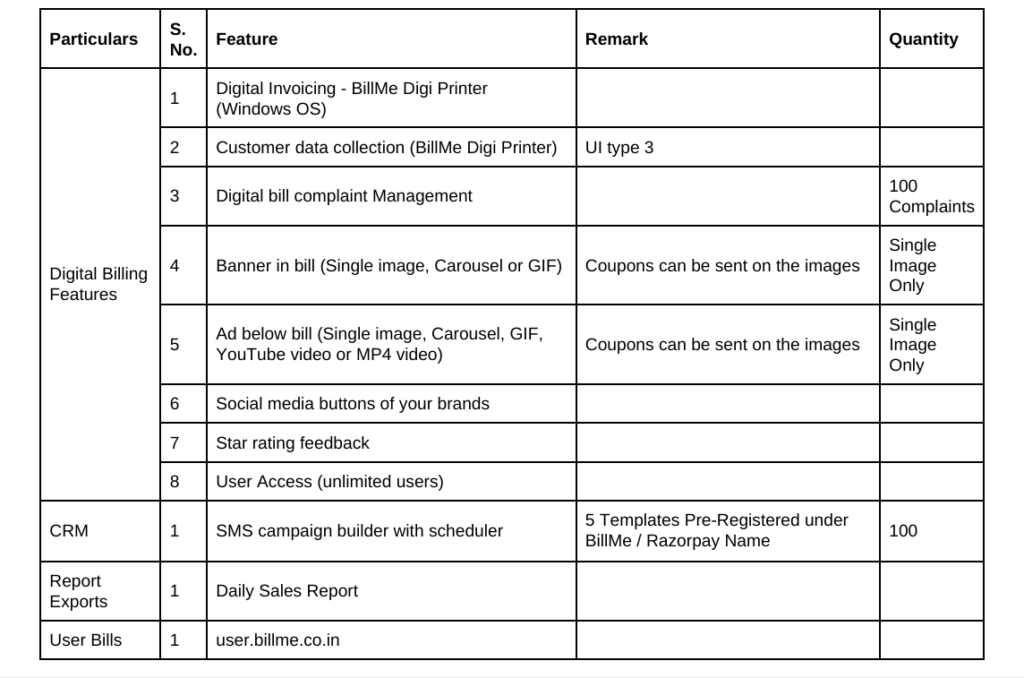

You may opt for additional dashboard services subject to extra charges (monthly/quarterly/annual). Fees can be deducted directly from Your settlement account.

Razorpay also provides Customisable Templates (Terms of Use, Privacy Policy, etc.) during onboarding for Your convenience. You use them at Your own risk after ensuring their suitability and legality. Razorpay holds no liability for Your use of such templates.

8. SPECIFIC TERMS FOR SNRR MERCHANTS

These apply if You hold a Special Non-Resident Rupee Account (SNRR) as per RBI Master Directions (Jan 1, 2016) and subsequent circulars.

Any person residing outside India may open an SNRR Account for bona fide rupee transactions, including:

(a) Investments in India;

(b) Import/export of goods or services;

(c) Trade credit or ECB transactions;

(d) Business-related INR transactions outside IFSC.

The account must specify its business purpose, must not bear interest, and must comply with RBI guidelines.

The tenure shall not exceed seven years, unless RBI approves an extension.

Balances are repatriable and transactions must be tax-compliant.

Entities from or incorporated in Pakistan or Bangladesh require prior RBI approval.

9. SPECIFIC TERMS FOR GAMING MERCHANTS

You represent and warrant that:

(a) You do not engage in or promote gambling, betting, or games of chance.

(b) Your services do not involve outcomes based on chance.

(c) Your activities comply with all Applicable Laws, including gaming restrictions.

(d) Services in Nagaland and Sikkim comply with their laws and valid licenses.

(e) You do not offer gaming or betting services in Telangana, Odisha, or Assam.

These warranties are reaffirmed daily during the term.

You must provide written confirmation certifying compliance with the above terms when using the Services, and Razorpay may request fresh confirmation anytime.

You shall indemnify Razorpay and its affiliates against all losses (including consequential or punitive losses) arising due to breaches of gaming laws or false representations.